hawaii capital gains tax worksheet

Hawaii State Tax Collector For more information see page 26 of the Instructions. Individual Income Tax Chapter 235 On net incomes of individual taxpayers.

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

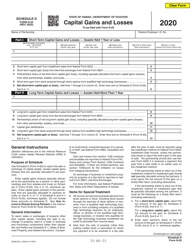

Form N-338Recapture of Tax Credit for Flood Victims Hawaii Composite Partner Worksheet Schedule DCapital Gains and Losses Schedule D-1Sales of Business Property Schedule K.

. Part II Long-term Gains and Losses. 2 83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev. Fill in oval if from Tax Table.

These capital gains bracket thresholds increase to 80800 and 501600 for married couples filing jointly. Or Capital Gains Tax Worksheet on page 35 of the Instructions. Place an X if from Tax Table.

808-587-4242 or 1-800-222-3229 Toll-Free. Allocation of capital gains and losses. State of Hawaii Department of Taxation PO.

There are some investments such as collectibles that are taxed. Hawaii taxes capital gains at a maximum rate of 725. State of Hawaii Department of Taxation PO.

Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. Or Capital Gains Tax. In Hawaii capital gains on.

The amount of net capital gain as shown on. For lines 9 through 17 must be property type code CAP and the dates must show a long-term holding period or. Download or print the 2021 Hawaii Form N-11 Individual Income Tax Return Resident Form for FREE from the Hawaii Department of Taxation.

You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202122. Of Taxations website at taxhawaiigov or you may contact the customer service representative at. Place an X if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338.

Locate to Hawaii all gains or losses resulting from the sale or exchange of real estate and other tangible assets which have a tax situs in Hawaii. Or Capital Gains Tax Worksheet on page 39 of the Instructions. You will pay either 0 15 or 20 in tax on long-term capital gains.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. STATE OF HAWAIIDEPARTMENT OF TAXATION SCHEDULE D FORM N-35 Capital Gains and Losses and Built-in Gains. Capital Gains Tax Worksheet is used to.

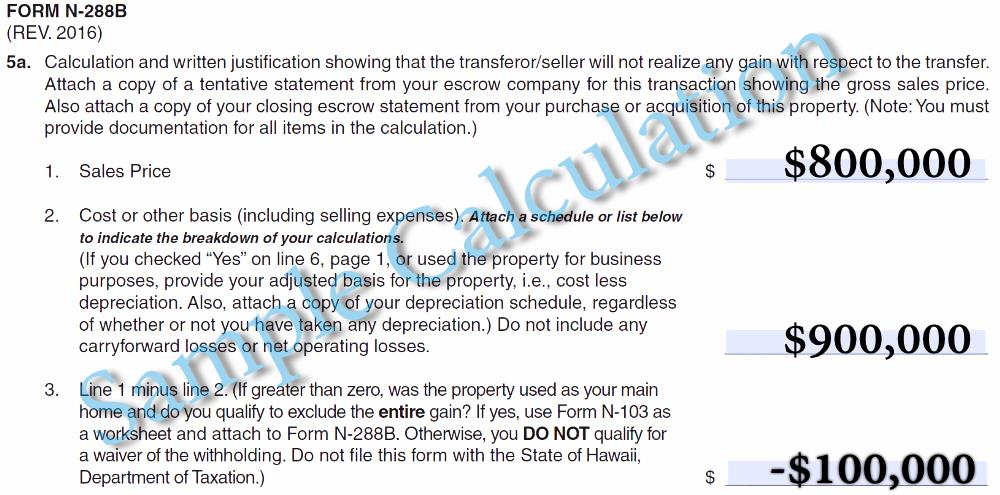

Capital Gains and Losses Use this section to enter information concerning capital gains and losses on the Hawaii Capital Gains and Loss Worksheet and the Hawaii Capital Gain Tax. 2016REV 2016 To be filed with Form N-35 Name Federal Employer. Ward attributable to Hawaii or capital loss carryfor - ward to the extent of net capital gain included in recognized built-in gain for the tax year attributable to Hawaii arising in tax years.

Ward attributable to Hawaii or capital loss carryfor - ward to the extent of net capital gain included in recognized built-in gain for the tax year attributable to Hawaii arising in tax years. Capital Gains Worksheet 2016. Fill in oval if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338.

Hawaii Income Tax Calculator Smartasset

Solved Please Help Me Find The Remaining Line Items Of A Chegg Com

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Harpta Firpta Tax Withholdings Avoid The Pitfalls

Hawaii Income Tax Calculator Smartasset

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Form N 20 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Hawaii Templateroller

Fill Free Fillable Forms For The State Of Hawaii

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Qualified Dividends And Capital Gain Tax Worksheet 2016 Pdf 2016 Form 1040line 44 Qualified Dividends And Capital Gain Tax Worksheetline 44 Keep For Course Hero

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

How To Report Capital Gains On Your Home Sale To The Irs Cmg Financial

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

The Go Curry Cracker 2016 Taxes Go Curry Cracker

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi